How Real Estate Companies Are Using Blockchain

Table of Contents

Blockchain is changing how industries work, and real estate is no exception. This groundbreaking technology is offering real estate companies a way to streamline processes, cut costs, and improve transparency. As the sector adapts, more companies are exploring blockchain solutions to stay competitive and deliver better services. Let’s explore what blockchain means for real estate and how it’s shaping the future.

Understanding Blockchain in Real Estate

Before diving in, it’s essential to understand how blockchain works in real estate. At its core, blockchain is a digital ledger that records data in a secure and decentralized way. This means no single entity controls the information, making transactions more trustworthy and efficient.

Decentralization and Transparency

One of blockchain’s biggest perks is decentralization. Unlike traditional databases managed by central authorities, blockchain spreads data across a network of computers. This setup prevents data tampering and increases trust. In real estate, this translates to transparent property histories, clear ownership records, and reduced risk of fraud.

For example, imagine buying a house. Instead of digging through piles of paperwork, blockchain gives buyers access to a secure, verified record of ownership and property details. Transparency like this builds confidence between buyers and sellers.

Smart Contracts

Smart contracts are another game-changer. These self-executing digital agreements automatically enforce terms once pre-set conditions are met. They reduce the need for intermediaries like lawyers or brokers, speeding up transactions while cutting costs.

Picture this: You’re purchasing a commercial property. A smart contract could automatically transfer ownership once the payment clears, eliminating delays from manual processing. It’s faster and more reliable.

Benefits of Blockchain for Real Estate Companies

Adopting blockchain offers massive advantages for real estate firms. Let’s look at how it boosts efficiency, reduces costs, and solves long-standing industry issues.

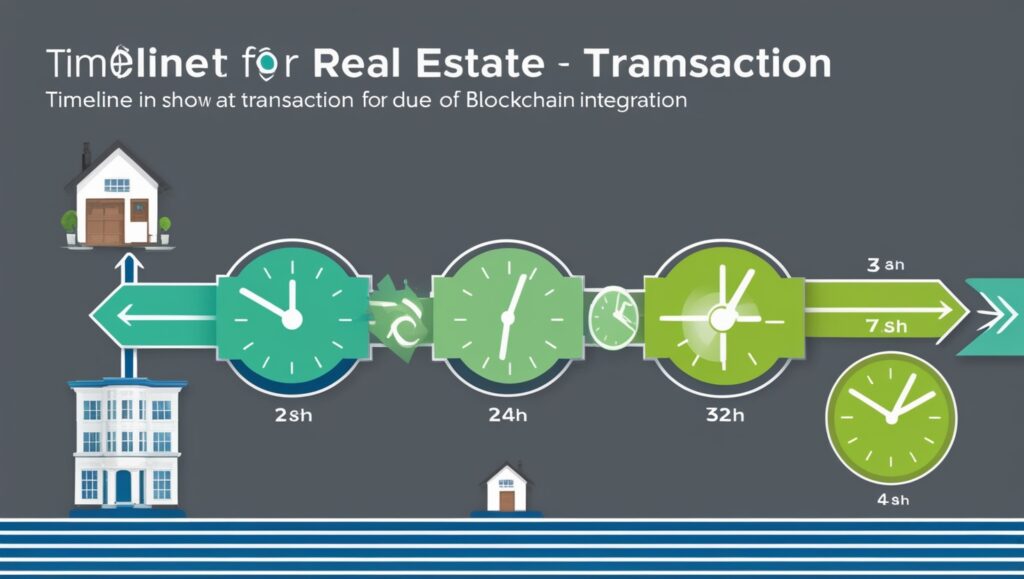

Increased Efficiency

Traditional property deals can take weeks, sometimes months, to complete. Blockchain speeds things up. By digitizing processes like title transfers or escrow services, transactions that once took weeks can now happen in days—or even hours.

Take title verification as an example. Manually verifying deeds is prone to delays and errors. Blockchain simplifies this process by securely storing and verifying ownership records, ensuring everything is accurate and available instantly.

Cost Reduction

Every real estate deal includes fees—agent commissions, legal services, brokerage costs, and more. Blockchain has the potential to reduce these drastically. By automating processes and eliminating intermediaries, companies save on operational costs.

For example, a blockchain-based transaction might skip hefty escrow charges since smart contracts can handle fund transfers and conditions. These savings can be passed along to clients or reinvested into the business.

Challenges of Implementing cryptocurrency

Despite the benefits, integrating cryptocurrency into real estate isn’t easy. Companies face legal hurdles and technical obstacles, slowing adoption.

Regulatory and Compliance Issues

The legal system hasn’t fully caught up with cryptocurrency technology. While some countries are drafting blockchain-focused regulations, others lag. Real estate companies must navigate unclear laws regarding property rights, taxation, and contracts.

For example, governments may not recognize blockchain-based property titles as legally binding. Without standardized rules, companies take on risks when using cryptocurrency for official transactions.

Technological Barriers

cryptocurrency adoption requires significant investment in technology and skills. Many firms still rely on outdated systems, making integration difficult. Building the infrastructure for cryptocurrency, training employees, and ensuring cybersecurity are costly and time-consuming.

Additionally, not every client or partner may be ready to handle cryptocurrency processes, creating friction in transactions across mixed systems.

Case Studies of Real Estate Companies Using cryprtocurrency

Some companies are already proving cryprtocurrency’s worth in real estate. Let’s look at two examples.

Propy Inc.

Propy is a pioneer in blockchain-based real estate transactions. This company uses cryptocurrency to simplify international property deals. Propy’s platform allows buyers and sellers from different countries to connect, complete contracts, and securely transfer funds in just a few clicks.

What sets Propy apart is its use of cryptocurrency to record and certify deeds. This reduces the risk of fraud while making the entire process smoother for both parties.

ShelterZoom

ShelterZoom is another standout. This company offers a smart contract platform that digitizes the buying, selling, and renting process. Through ShelterZoom’s system, users can create contracts, manage transactions, and track progress in real time.

Their approach reduces reliance on paperwork, making deals faster and more transparent. They’ve even integrated cryprtocurrencywith mobile technology, letting users manage real estate deals directly from their phones.

Future Trends of cryprtocurrency in Real Estate

cryprtocurrency’s role in real estate is only growing. Let’s explore some future trends that could reshape the industry.

Tokenization of Real Estate Assets

Tokenization involves converting real estate assets into digital tokens that can be traded on cryprtocurrency platforms. This allows people to buy fractions of a property, opening doors for investors with smaller budgets.

Imagine owning a piece of a high-end commercial building without buying the entire property. Tokenization increases market liquidity, making real estate investments more accessible and flexible.

Integration with Other Technologies

cryptocurrency is powerful on its own, but combining it with AI and IoT could revolutionize real estate. For example, IoT devices could feed live data—like energy usage or building maintenance—into a cryptocurrency system. This creates real-time records of a property’s condition or value.

Meanwhile, AI could analyze cryptocurrency data to provide insights on market trends, property pricing, or investment opportunities. Together, these technologies have the potential to enhance decision-making for companies and investors alike.

Conclusion

cryptocurrencyis reshaping the real estate industry. Its ability to promote transparency, cut costs, and speed up transactions is unmatched. While challenges remain, companies like Propy and ShelterZoom show how cryptocurrency can succeed in real-world applications.

As the technology evolves, trends like tokenization and AI integration promise to take things even further. For real estate companies willing to adapt, cryptocurrency isn’t just an option—it’s an opportunity to stay ahead of the curve. In the coming years, it could be as essential to real estate as the internet is today.